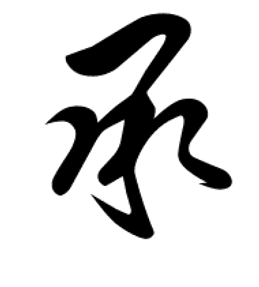

商业遗产

关键本质 for 后继

过渡 &业务 连续性

突然失去关键人物可能对公司的运营和财务稳定性造成灾难性的影响。 确保您的最终遗产仍然是您的最高成就。即使在你的一生之后。企业继任计划冗长而复杂,但它有它的回报——为您的家庭带来稳定和安全、企业的延续、您的目标的推进以及您自己的安心。

KEYMAN INSURANCE 的重要性

1. 业务连续性

如果关键人物不幸死亡,它可以防止业务风险。

2. 节税

保费paid 将允许公司节省 他们公司的税。

3. 现金流和信用额度

由于 Keyman 的死亡而导致的业务信用额度中断会严重影响业务。

4.内部稳定性

关键员工的士气得到了提振。他/她觉得自己很重要。归属感提高了生产力并有助于留住关键员工。

5. Protect 公司估值

它在买卖协议的情况下保护公司的估值。

来源: UOB 小型企业调查 2014

Summary

Keyman 保险保护公司的财务利益并确保其生存。它为公司注入资金——即时现金流,增强其流动性状况。商业周期中的现金流可能会发生变化,因此,企业可能会出现流动性问题,导致被迫抛售甚至更多的财务损失。此外,如果关键人员保险的保费符合新加坡税务局设定的条件,则可能有资格获得税收减免。

KeyMan 保险 / 董事和高级职员的责任保护

董事和高级职员责任 (D&O 责任保险) 为您的董事和管理人员提供因犯下或据称犯下的不法行为而导致的个人责任和财务损失保险。 私营公司必须确保他们是遵守与整个运营相关的法律框架——这包括谨慎管理与员工、债权人、客户和供应商的专业关系。

中小企业企业有必要投保D&O保险吗?

许多中小企业董事和高级管理人员意识到他们面临无限的金融和信贷负债,但不知道解决方案。这导致他们自己和公司处于危险之中——在日常运营中靠运气赌博。

相同的法律法规适用于大小公司,因此中小企业的董事与大型或上市公司的董事负有相同的责任。 投诉可能来自您商业的许多领域操作。因此,a prudent company 应确保 D&O 保险是一种强制性保护,因为在许多情况下,公司的董事将承担责任,即使错误不仅仅是你的。通过监督公司,您不仅要对自己的日常行为负责,还要对员工的行为负责。

主要风险敞口

股东/利益相关者索赔的脆弱性

性骚扰、歧视指控和其他违反就业惯例的行为

会计违规

与并购相关的风险敞口

公司治理要求, 监管调查。

招股说明书中的虚假陈述

债权人的债权

公司破产

竞争对手的索赔/诽谤

内部法律追查

产品专利权